ev tax credit 2022 infrastructure bill

Under the bill buyers of previously-owned electric vehicles would be eligible for a 4000 credit or 30 off the cost of the vehicle whichever is. The 1 trillion Bipartisan Infrastructure Bill became law on November 5.

Used Ev Tax Credit Union Built Bonus Part Of House Social And Climate Bill Now Headed To Senate

Colorado EV Tax Credits.

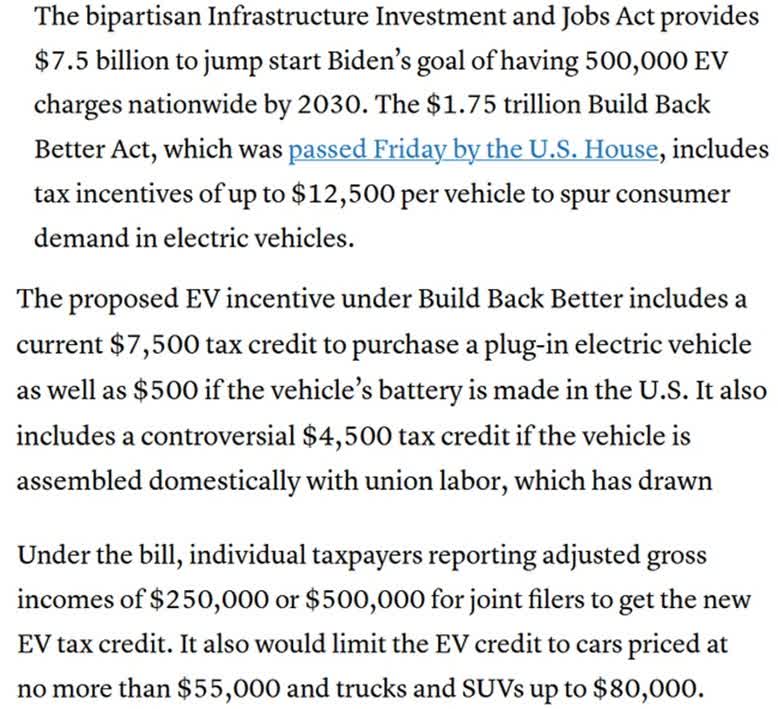

. Currently all-electric and plug-in hybrid cards purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The eventual credit you receive depends on the car manufacturer of your EV and the size of the EVs battery pack. Democratic senator Joe Manchin on Tuesday said a proposed 4500 EV tax-credit bonus for union-made vehicles is now gone from the Senates version of.

The West Virginia Democrat who previously described federal tax credits for EVs as ludicrous announced a surprise deal with Senate Majority Leader Chuck Schumer on a reconciliation package. Enhanced credits for cars assembled in the United States andor assembled by union labor would not take effect until 2022. The new law changes which electric vehicles will qualify for the Clean Vehicle Credit.

That cap is lifted on January 1 2023 so cars tagged as manufacturer sales cap met will not qualify for the electric car tax credit until. The law which takes effect immediately ends credits for about 70 of the 72 models that were previously eligible according to the Alliance for Automotive Innovation. Ford Transit Van.

A large part of the 12500 figure comes from 4500 for EVs made at unionized factories. The price caps for. A Senate Democratic deal includes a new 4000 tax credit for used electric vehicles and other new tax credits and grants for automakers to retool factories to.

EV tax credits in Bidens Build Back Better Act will help sell more cars than new chargers in infrastructure bill Published Fri Nov 19 2021. January 25 2022. 2022 models that likely qualify for a tax credit under the Inflation Reduction Act.

12 Trillion Infrastructure Bill Has Funds For Cars Planes and Trains. Ford Escape PHEV and Mustang MACH E. The bill requires that in 2023 40 of critical minerals in an electric vehicle battery must be extracted or processed in the US or a country where.

1 2023 more caveats come into effect. For this purpose the bill provides a 7500 tax credit to anybody who buys US-made electric vehicles starting 2022 till 2026. EV Tax Credit Expansion.

The bipartisan Infrastructure Investment and Jobs Act provides 75 billion to jump start Bidens goal of having 500000 EV charges nationwide by 2030. Sedans have to be under 55000 to qualify and the cost of trucks vans and sports utility vehicles cant exceed 80000. The 175 trillion Build Back Better Act.

Bill Howard Credits for EV Buyers Awaits Action by Congress. Best Small SUVs And Crossovers. It also includes tens of billions of dollars in new loan tax credit and grant programs.

How the EV tax credits in Democrats climate bill could hurt electric vehicle sales Published Wed Aug 10 2022 1055 AM EDT Updated Wed Aug 10 2022 309 PM EDT Michael Wayland MikeWayland. About 20 model year 2022. For 2023 EV batteries must have at least 40 of battery parts and materials sourced and made in a.

For example when it comes to the Chevrolet Bolt EV only 2017-2020 models are. If you buy or convert a light-duty EV in Colorado you may be eligible for a 2500 tax credit 1500 for leasing in. BMW 330e and X5.

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December. The renewal of an EV tax credit for Tesla provides new opportunities for growth. Now only electric vehicles with final assembly in North America will.

2 days ago3750 of the credit eligibility is based on battery manufacturing content. A maximum 12500 federal EV tax credit including a bonus for union-made vehicles appears to have survived the negotiation process and is now a likely part of the infrastructure bill. Most Tesla cars sold starting on January 1 2022 would be.

The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023. The bill retains the 7500 maximum tax credit but scraps the 200000-unit production limit that GM and Tesla hit long ago and which was about to affect other brands like Toyota and Ford. The bill restructures the existing 75000 new EV tax credit and creates a new 4000 rebate for used EVs.

Best SUVs For 2022.

Elon Musk Calls For Senate Not To Pass The Build Back Better Act Tesla Doesn T Need The 7 500 Electrek

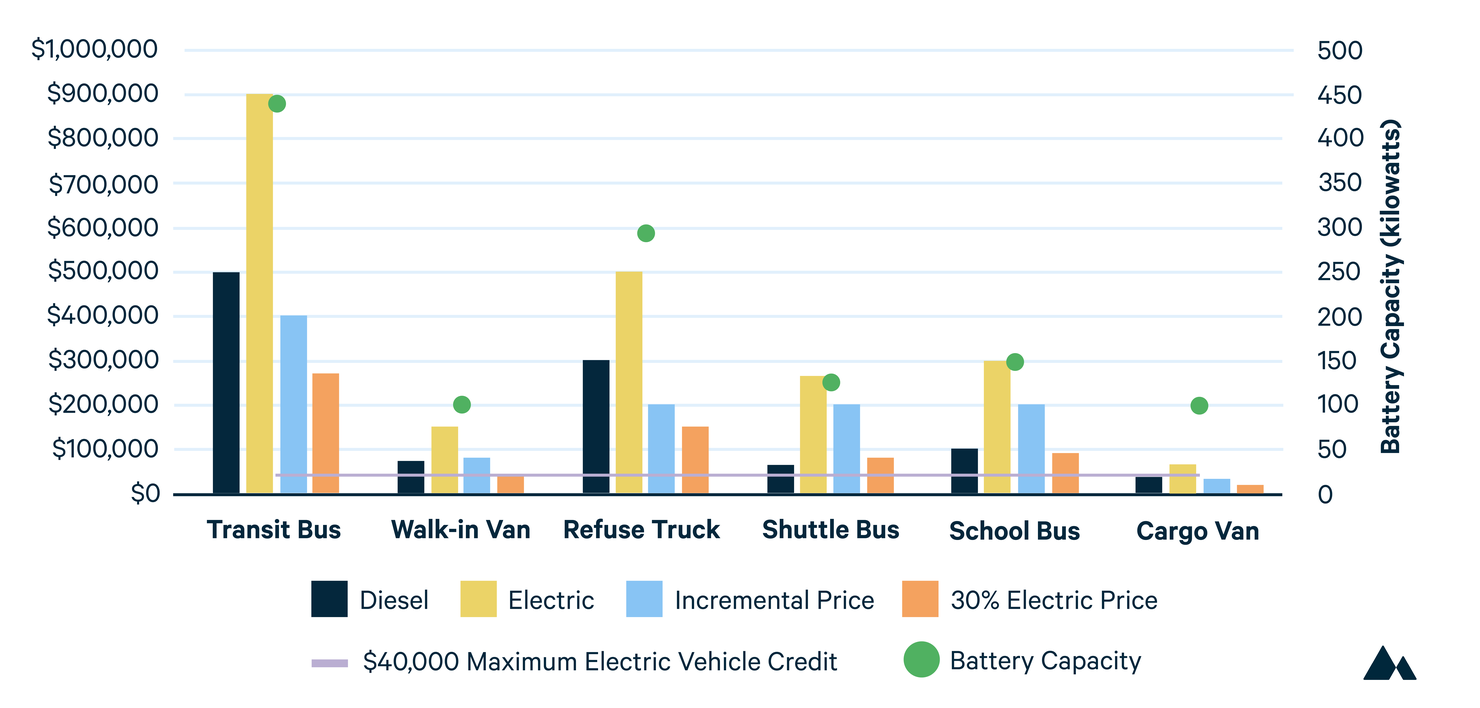

Inflation Reduction Act Examining Electric Vehicle Subsidies For Medium And Heavy Duty Vehicles

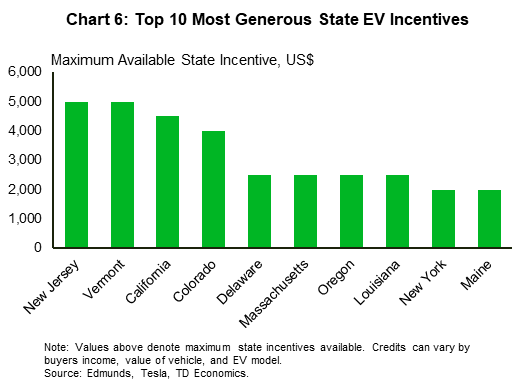

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Infrastructure Bill Could Be Strongest Ever U S Climate Action If Congress Acts

Inflation Reduction Act Examining Electric Vehicle Subsidies For Medium And Heavy Duty Vehicles

What To Expect In 2022 For Global Electric Vehicle Sales Seeking Alpha

The Crosswalk Bandits Of Los Angeles In 2022 Street Installation Urban Area Los Angeles

It S Not A Giant Ice Cube Here S How An Air Conditioner Works To Cool Your Home Air Conditioning Installation Window Ac Unit Central Air Units

What The Inflation Reduction Act Means For Electric Vehicles Union Of Concerned Scientists

The Canada Us Electric Vehicle Market Navigating The Road Ahead

Ap Fact Check Biden Hypes 1t Bill Impact On Electric Cars Ap News

Electric Vehicle Stocks Tumble After Manchin Rejects Biden S Climate And Social Plan

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

What The Bipartisan Infrastructure Bill Means For Ev Buyers Techrepublic

What Is In The Bipartisan Infrastructure Legislation Npr

Manchin Objects To Federal Tax Credit For Union Made Electric Vehicles A Provision Of Biden S Social Spending Package The Washington Post

What The Inflation Reduction Act Means For Electric Vehicles Union Of Concerned Scientists